5 Simple Budgeting Methods to Reach Your Financial Goals

Ever feel like no matter how hard you try, budgeting never seems to stick?

You’re not alone!

Many of us struggle with managing our money in a way that helps us reach our financial goals without feeling like we’re constantly depriving ourselves.

But fear not! I’m here to break it down for you and share five simple budgeting methods that can make 2024 the year you take control of your finances.

Let’s dive in, shall we?

Also read: How to stay consistent with your goals

Why Is Budgeting Difficult?

Budgeting can be tough for a variety of reasons. First off, it's not something most of us were taught in school, so we're often left figuring it out on our own.

Then there’s the fact that life is unpredictable—unexpected expenses pop up, and sometimes our best-laid plans just don't pan out.

Another challenge is that budgeting requires a good amount of discipline and consistency.

It’s easy to start with the best intentions but hard to keep up with it month after month, especially when temptations arise. Plus, let’s face it, tracking every penny can feel tedious and time-consuming.

But here's the good news: budgeting doesn’t have to be painful.

With the right method, it can actually be empowering and, dare I say, fun!

So let’s look at five different budgeting methods that can help you take charge of your money in 2024.

5 Simple Budgeting Methods to Try in 2024

I LOVE finding new ways to grow wealth! So, I have tried and tested a fair few budgeting methods over the years.

Here are my top 5 that helped me to save more money easily.

Also see: How to double your income in 6 months

1. 50/30/20 Budget

The 50/30/20 budget is a great starting point for budgeting newbies. It’s simple, straightforward, and easy to stick to. Here’s how it works:

50% for Needs: Allocate 50% of your income to essentials like rent/mortgage, utilities, groceries, and transportation.

30% for Wants: Spend 30% on non-essentials that make life enjoyable, such as dining out, entertainment, and hobbies.

20% for Savings and Debt Repayment: Put 20% towards savings, investments, and paying off any debt.

This method is flexible enough to accommodate different lifestyles while ensuring that you’re saving and paying off debt.

It’s all about balance, and who doesn’t love a balanced life?

2. 60/20/20 Budget

If you’re needs are a bit more expensive, the 60/20/20 budget might be right up your alley. Here’s the breakdown:

60% for Needs: Allocate 60% of your income to cover all your essential expenses.

20% for Wants: This category shrinks to 20%, but it’s still enough to enjoy some of life’s little luxuries.

20% for Savings and Debt Repayment: Same as the 50/30/20 method, put this towards building your savings and paying down debt.

This approach is ideal if you’re working towards specific financial goals like building an emergency fund or saving for a big purchase.

It’s a bit more restrictive on the “wants” but can help you achieve your financial goals faster.

3. Zero-Based Budget

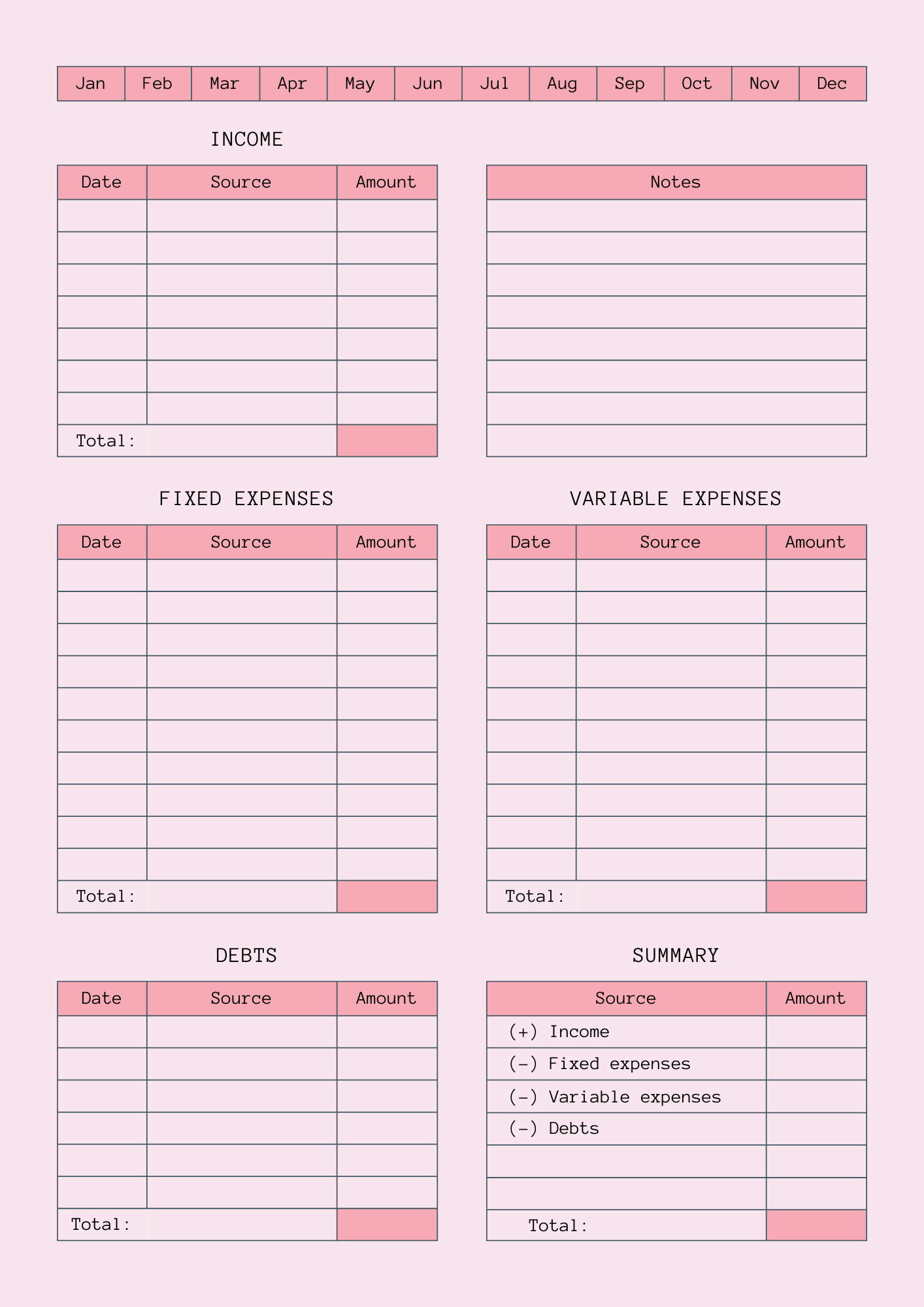

The zero-based budget is for those who love detail and control. Every dollar of your income is assigned a purpose, and by the end of the month, your income minus expenses should equal zero. Here’s how to implement it:

List all your income sources.

List all your expenses: This includes everything from fixed bills to variable expenses like groceries and entertainment.

Assign every dollar: Make sure every dollar has a job, whether it’s going to savings, debt repayment, or daily expenses.

This method requires a bit more effort upfront, but it gives you a clear picture of where every penny is going.

It’s perfect for those who want to make sure their money is being used efficiently and purposefully.

Click the link above to download my FREE zero-based budget planner!

4. Incremental Budgeting

Incremental budgeting is a more dynamic and flexible approach. Instead of starting from scratch each month, you build on your previous budget. Here’s how it works:

Review last month’s budget: Look at what you spent and adjust for any changes in income or expenses.

Make incremental changes: Increase or decrease your budget categories as needed. For example, if you spent more on utilities last month, adjust your budget accordingly.

This method allows for gradual improvements and adjustments, making it easier to adapt to changing financial situations.

It’s great for those who want to refine their budgeting process over time.

5. Pay Yourself First

Now for my favourite!

The “Pay Yourself First” method flips traditional budgeting on its head.

Instead of saving what’s left after expenses, you prioritize your savings and investments first. Here’s how to do it:

Determine your savings goals: Decide how much you want to save each month.

Transfer savings first: As soon as you get paid, transfer the predetermined amount into your savings or investment accounts.

Live on the rest: Use the remaining money for your expenses and discretionary spending.

This method ensures that you’re prioritizing your financial goals and not just saving what’s left over.

It’s a great way to build a strong savings habit and ensure you’re always putting your financial future first.

Top Tips to Stick to Your Budget

Alright, now that we’ve covered the five budgeting methods, let’s talk about some top tips to help you stick to your budget:

Automate Your Savings: Set up automatic transfers to your savings account so you don’t have to think about it. Out of sight, out of mind!

Use Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), or even a simple spreadsheet can help you track your spending and stay on top of your budget.

Set Realistic Goals: Make sure your budget is achievable. Unrealistic goals can lead to frustration and burnout.

Review Regularly: Take time to review your budget regularly. Adjust as needed to accommodate changes in income or unexpected expenses.

Reward Yourself: Celebrate your financial wins, no matter how small. Rewards can keep you motivated and committed to your budgeting goals.

Stay Flexible: Life happens, and sometimes you need to adjust your budget. Flexibility is key to long-term success.

Keep the Big Picture in Mind: Remember why you’re budgeting in the first place. Whether it’s financial freedom, paying off debt, or saving for a dream vacation, keeping your goals in mind will help you stay on track.

Avoid Impulse Purchases: Give yourself a cooling-off period before making any non-essential purchases. This can help you avoid buyer’s remorse and keep your spending in check.

Find a Budget Buddy: Share your budgeting journey with a friend or family member. Accountability can make a big difference.

Stay Positive: Budgeting can be challenging, but stay positive and remind yourself of the progress you’re making.

There you have it, ladies! Five simple budgeting methods to help you reach your financial goals in 2024, plus some handy tips to keep you on track.

Want to know how you can make budgeting even easier?

Start a second stream of income! This is a GREAT way to increase the amount of cash you have to play with each month which makes budgeting a LOT easier (trust me!).

Check out these helpful posts about side hustles for some inspiration: